An early-stage venture capital firm investing in founders rebuilding

foundational industries.

The Foundational Industries of our economy have been neglected for decades. This is changing.

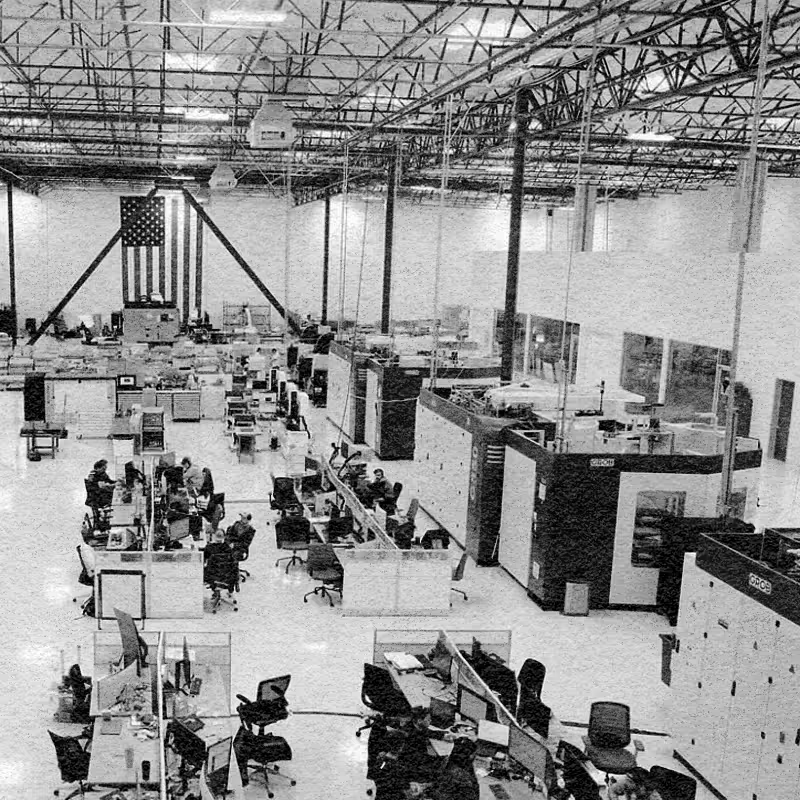

From manufacturing to logistics and defense to energy, these sectors are the backbone of our GDP but disruptive technologies have not been applied to these spaces. The best tech founders are turning their attention here and the value to be created offers a once-in-a-generation opportunity.

A partnership built for partnership.

We bring our whole team's investing and operating experiences to everything we do. We don't shy away from hard work and always aim to be a founder's first call.

.webp)

.avif)

A technology investor who built an early focus on the industrial sector. Lead investor in companies such as Desktop Metal (NYSE: DM), Onshape (PTC), and Framebridge (GHC), among others.

.avif)

Operator turned investor. Early employee and a senior exec at Uber as the business achieved massive scale. Led the US/Canada Rides business, built the Incubator and the New Mobility business.

An early stage investor and operator with a decade of experience, dedicated to partnering with founders audacious enough to rethink entire industries.

Early stage investor and operator with focus on the tech and financial services sectors. Former Head of Ops at Nubank. Led investments at Capchase, AtomicVest, Finkargo, and others.

.avif)

25 years in venture, including 18 years managing operations. Helped grow two previous VC firms from early stages into well-established firms with efficient operations.

Early stage investor focused on how advanced technologies will transform the industrial base and improve national security. Former investor at America’s Frontier Fund and Growth Lead at FutureFit AI.

Former founder and operator at the intersection of supply chain and manufacturing. Early employee, Chief of Staff, and former Head of R&D Operations at Bowery Farming.

An administrative operator with years of experience in data management and project coordination, supporting top executives in the tech industry.

%20(1).jpg)

Strategic operator building core systems in venture operations and communications.

%201.svg)

.avif)

.avif)

.avif)

.avif)

.avif)